Years ago, at a different software company, we were interviewing VC firms with hopes of bringing on one as an investment partner. During an interview, one asked, how much are you willing to spend to acquire a customer?

This is a question that many people don’t know how to answer. After all, the proper answer is a bit complicated. If you don’t spend enough, you will lose customers to your competitors. If you spend too much, you can quickly lose all of your profits.

To really know the optimal CAC amount, you also need to know your LTV. In this article, we’ll discuss both your CAC and LTV and how they are used together.

What is LTV?

LTV stands for Lifetime Value and is a metric that helps you understand the total value of your customer. This is a particularly important metric for recurring revenue business models, like software or subscription box companies, where very little revenue is made on the initial purchase.

A one-time purchase business will limit their marketing budget based on the initial purchase value the customer makes. For example, if a customer sells a one-time product of $599, they aren’t likely going to spend more than $100-$200 to acquire that customer. However, if that business receives $599 each month for an enterprise software tool, they might be willing to spend $2,000 or more to acquire the customer, depending on the actual LTV of the customer.

Knowing your LTV will help you better understand that perfect mix of selling your product to the most amount of people for the most profit possible.

Consider Retention Rate Too

Most businesses don’t have as predictable of a revenue stream as software and other subscription businesses, so LTV may not be the only customer loyalty metric you use. For example, what if you still want to measure how many of your e-commerce customers are coming back again and again?

A way to measure this is using Retention Rate, or how many of your customers come back to buy from you again. Retention Rate is great for e-commerce companies or retail stores. To calculate the retention rate, subtract the number of new customers during a period from the number of customers at the end of the period. Then divide that number by the number of customers at the beginning of the period. Lastly, multiply that number by 100.

Retention Rate: ((E-N)/S) x 100.

- E = Total customers at end of the period.

- N = Total new customers acquired during the period.

- S = Total customers at the start of the period.

How do I calculate LTV?

There are a number of ways to calculate LTV. To create it manually can be a multi-step process, depending on how you are calculating it. Read this Medium article that includes 5 ways to calculate LTV. Alternatively, here is how Hubspot is recommends to calculate your LTV:

- Calculate average purchase value: Calculate this number by dividing your company’s total revenue in a time period (usually one year) by the number of purchases over the course of that same time period.

- Next, calculate the average purchase frequency rate: Calculate this number by dividing the number of purchases by the number of unique customers who made purchases during that time period.

- Calculate customer value: Calculate this number by multiplying the average purchase value by the average purchase frequency rate.

- Calculate average customer lifespan: Calculate this number by averaging the number of years a customer continues purchasing from your company.

- Finally, calculate CLTV: multiply customer value by the average customer lifespan. This will give you the revenue you can reasonably expect an average customer to generate for your company over the course of their relationship with you.

If that seems complicated, don’t worry. Option 2 below shows a way to automate calculating LTV inside of your Keap application.

How do I calculate LTV in Keap?

With all the different ways there are to calculate LTV, how is it done inside of Keap? Well, there isn’t a direct way to calculate the LTV of all your customers, but they do make it easier to do it manually.

Option 1 – Use Keap Data and Calculate it Manually

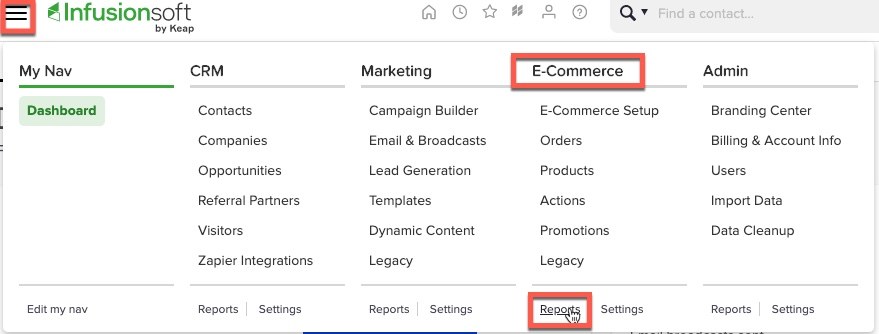

Infusinsoft has a report called Customer Lifetime Value report. This report will allow you to see the total amount a customer has spent with you and what their average payment was. This will be helpful information to use when creating your LTV figures manually.

To get this report, you must have access to the E-Commerce module (which is required to run any sort of financial reporting or process any billing within Keap for that matter).

- Click on the top menu icon.

- Navigate to E-Commerce and select Reports in the bottom left.

- About 2 / 3 way down the list, click on Customer Lifetime Value.

Once you open the report, you will be able to customize what data is shown. For example, you can only see the Customer Lifetime Value for purchases of specific products, over a given period of time, or by people with specific tags.

You can then export this data into a CSV file and use it to calculate your LTV using any of the methods above.

Option 2 – Use Graphly to see Visual Keap Dashboards

Graphly makes calculating the LTV of your Keap customers very easy. Simply add one of the four LTV reports to your graphly dashboard and customize it using the criteria builder.

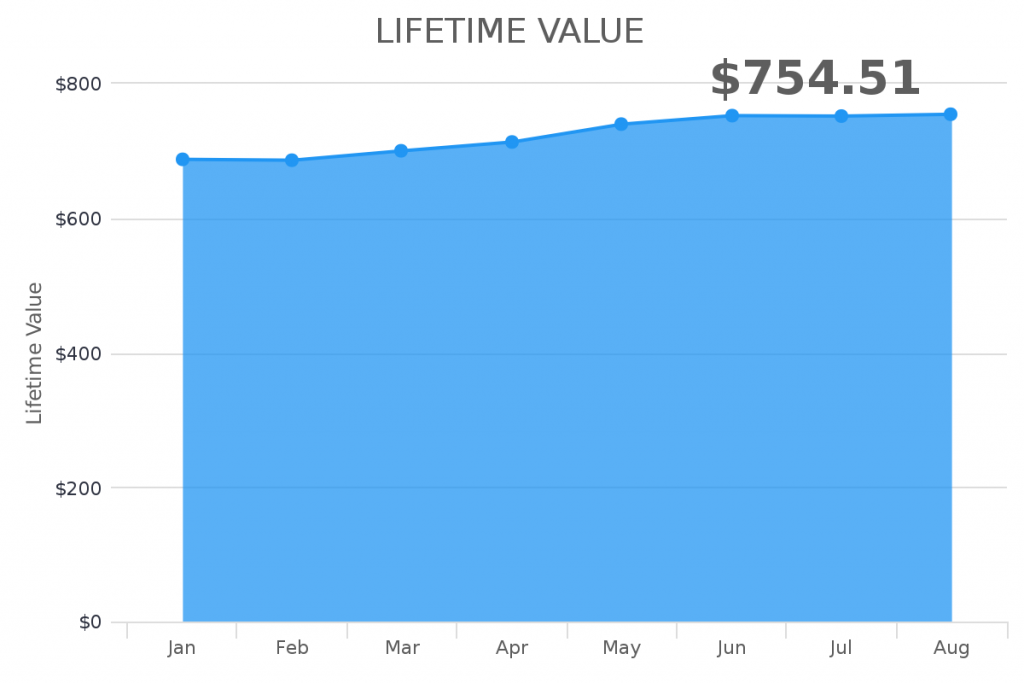

Lifetime Value

Most companies will use the Lifetime Value report, which shows you the trend of the current LTV of your customers throughout the time period you choose inside of the criteria builder.

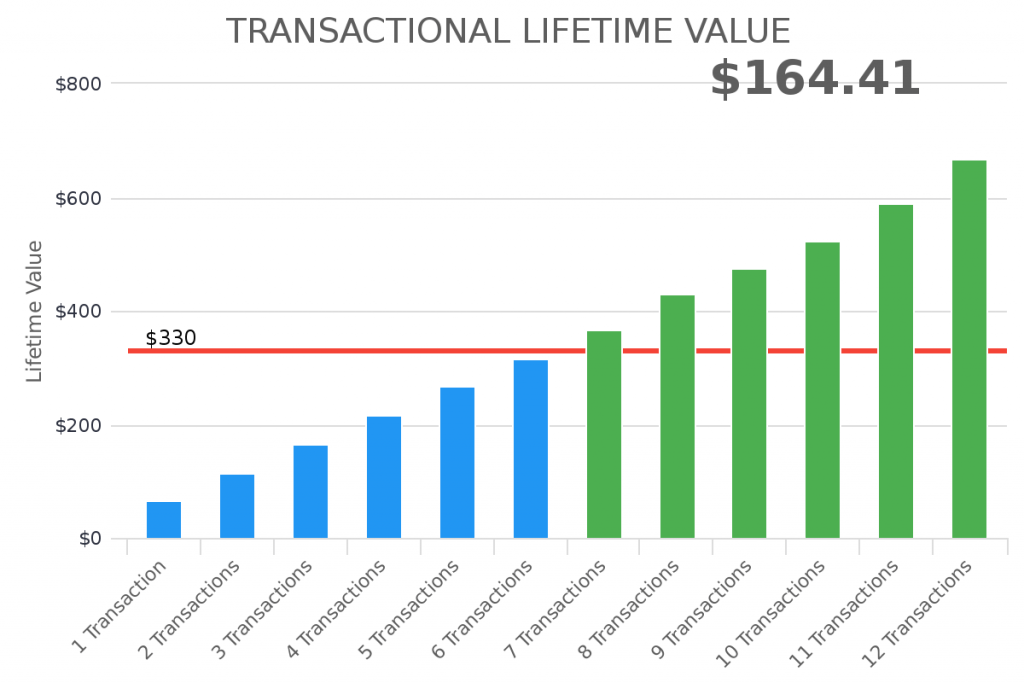

Transactional Lifetime Value

If you want to see how your LTV is growing with each transaction, use the Transactional Lifetime Value report. In this report, you can set a breakeven line to help monitor the point in your customer journey where your business model becomes profitable.

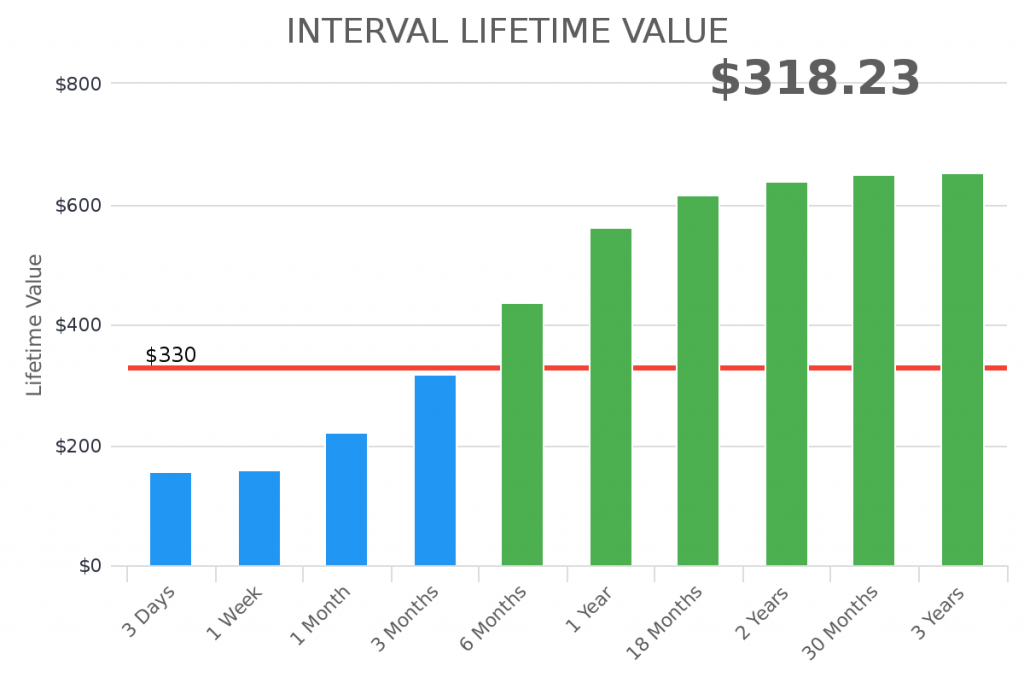

Internal Lifetime Value

Similarly to the Transactional Lifetime Value report, the Interval Lifetime Value report will show the LTV over specific intervals to help you see the changes over time. This report also includes a breakeven line, which is completely optional.

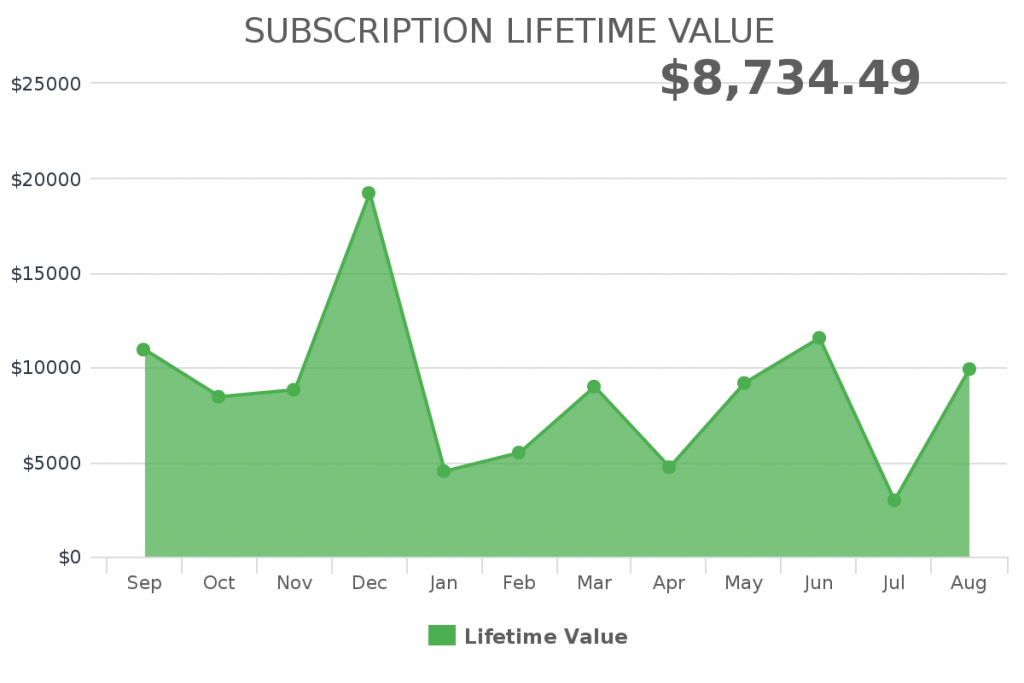

Subscription Lifetime Value

The Subscription Lifetime Value report will show the LTV of your customers for specific subscriptions. This report is great for companies that want to monitor the different LTV for customers on different subscriptions.

What is CAC?

Now that we have discussed LTV, let’s talk about the metric that started this conversionaation: CAC.

CAC stands for Cost to Acquire a Customer. It’s the metric that shows how much of your total costs are going towards acquiring new customers. You might be thinking “I want to spend the least amount of money as possible” to acquire a customer. That isn’t necessarily the right strategy.

Dan Kennedy, one of the most revered direct response marketers, said “the business that can spend the most to acquire a customer – wins.”

Think about it. If your competitor is spending $200 to acquire each customer and you are only spending $25, you are very unlikely to have very many customers.

Spending too much will cut into your profits while spending too little will reduce the amount of customers you acquire.

So how do you know how much to spend on acquiring a customer? Consider using a target LTV:CAC ratio.

What is LTV:CAC?

LTV:CAC is a ratio to compare your LTV to CAC. The higher my LTV, the more I have to spend on acquiring customers. The right LTV:CAC ratio is going to be different for each industry. For Saas business models, it’s generally accepted that a ratio of 3:1 is going to drive the most profits. A ratio of 1:1 is going to eat any revenue you make. A ratio of 5:1 means you aren’t investing as much into your marketing as you should.

Channel CAC

In this article, Neil Patel explains the advantages to calculating a more detailed view of CAC. For example, your actual CAC for customers generated from paid ads might be different from customers generated from affiliates and referral partners. Knowing which channels have a better LTV:CAC ratio might help you understand where to double down on your marketing budget.

How do I calculate CAC?

Calculating your CAC is usually pretty simple. First, total the amount of money you spend your sales and marketing efforts over a given period of time. This will include your sales and marketing salaries, creative advertising costs, and the amount you spend on your sales and marketing software (CRM, autoresponder, landing page builder, etc.). Once you have that calculated, divide it by the number of new customers you acquired over that same period of time. This is your CAC.

CAC: total sales & marketing costs for period / # of customers acquired during period

Unfortunately, there isn’t a way to calculate CAC inside of your Infusionosft account without the true costs of all your sales and marketing department being accounted for within Keap. The only way to keep track of this metric will be using an accounting tool or using a spreadsheet like Google Sheets or Microsoft Excel.

Making Decisions with LTV and CAC

Now that you understand the importance of LTV and CAC, how to calculate LTV and CAC, and why LTV:CAC needs to be monitored, it’s time for you to start using these metrics to scale your business.

Here are a few additional resources for you to use:

- 5 Ways to Increase LTV for E-commerce Businesses

- Building LTV & CAC Models for SaaS Businesses

- Guide to Understanding and Improving your CAC

Start measuring your LTV in real-time using a visual Keap dashboard. Graphly offers 165+ report templates that can be customized to show the precise data you need to grow and scale your business. Create a free account today.